13+ Tax Preparation Fee Schedule 2020 Pdf

Ordering tax forms instructions and publications. You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR.

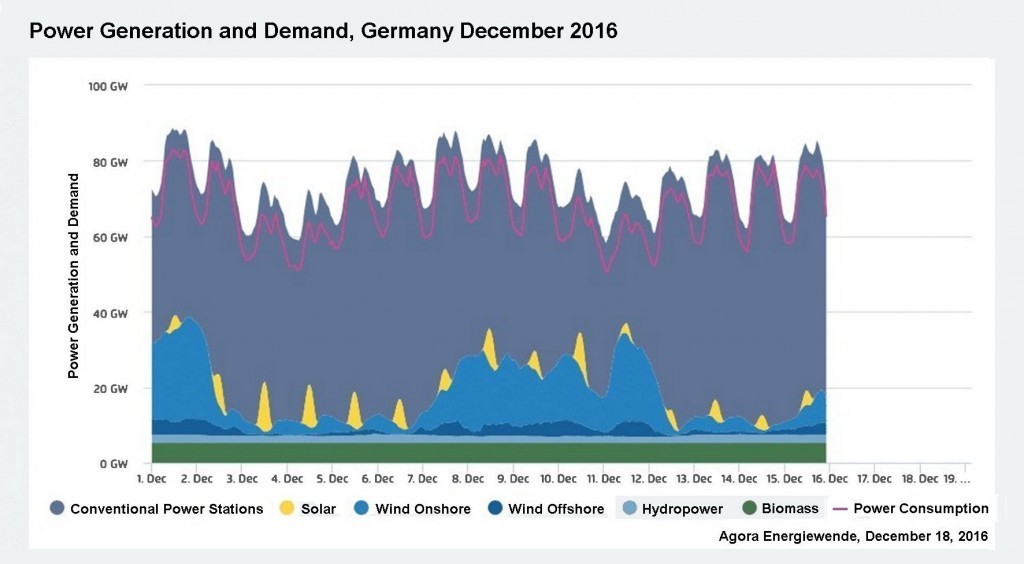

The End Of The End Of The Energiewende

California Code of Regulations Home.

. Article 20 of the US-China income tax treaty allows an. During these maintenance windows access to the site may be intermittent or disrupted. 12-01-2022 to 21-01-2022.

10 days Online Research Methodology Course for MPhilPhDPDF Scholars in Social Sciences wef. On July 13 1977 45 years ago Wednesday a major blackout hit New York City. SAMgov will undergo scheduled maintenance on Tuesdays Thursdays and Fridays from 800 PM ET - 1100 PM ET.

B Increased eligibility for certain small businesses and organizations 1 I N GENERALDuring the covered period any business concern private nonprofit organization or public nonprofit organization which. Download Mobirise Website Builder now and create cutting-edge beautiful websites that look amazing on any devices and browsers. MOBIRISE WEB BUILDER Create killer mobile-ready sites.

1st year and BTech. However state tax preparation may. Still cant find what youre.

SAMgov will undergo scheduled maintenance on Tuesdays Thursdays and Fridays from 800 PM ET - 1100 PM ET. Search the most recent archived version of stategov. This Friday were taking a look at Microsoft and Sonys increasingly bitter feud over Call of Duty and whether UK.

970 Tax Benefits for Education. For 25 hours the darkness led to total chaos with widespread looting and fires in the streets. Before sharing sensitive information make sure youre on a federal government site.

Sufficient facts to justify the exemption from tax under the terms of the treaty article. Notification regarding Income Tax Option for Old Regime OR New. The type and amount of income that qualifies for the exemption from tax.

5-day early program may change or discontinue at any time. If your reimbursements are less than your moving expenses enter the amount of moving expenses from line 5 of federal Form 3903 on Schedule CA 540NR line 13 column C. These are planned maintenance events and will persist until further notice.

This page may have been moved deleted or is otherwise unavailable. 133 later and Notice 2022-04. Feature available within Schedule C tax form for TurboTax filers with 1099.

If emailing us please include your full name address including postcode and telephone number. Department of State Archive Websites page. Passed the House as the Hiring Incentives to Restore Employment.

Institute Level Physical counselling schedule for BTech. He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021. Regulators are leaning toward torpedoing the Activision Blizzard deal.

John properly filed his 2020 income tax return. Schedule 1 Form 1040 line 21. Go to IRSgovOrderForms to order current forms.

If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan you will not be eligible to receive your refund up to 5 days early. Charles Rangel DNY-13 on October 27 2009. The fee for policy and plan years ending on or after October 1 2020 but before October 1 2021 remains at the applicable rate of 266 multiplied by the average number of lives covered under the policy or plan.

Enabling tax and accounting professionals and businesses of all sizes drive productivity navigate change and deliver better outcomes. 13-2099 Financial Specialists All Other 15-0000 Computer and Mathematical Occupations. 13-2072 Loan Officers.

During these maintenance windows access to the site may be intermittent or disrupted. Forms 990-T 4720 are available for e-filing in 2022. Electrical and Instrumentation Engg.

Our current opening hours are 0800 to 1800 Monday to Friday and 1000 to 1700 Saturday. California Code of Regulations. 13-2090 Miscellaneous Financial Specialists.

Committee consideration by Senate Finance House Ways and Means. To do so you. In September 2020 just before the 2020 general election Californians were also divided 47 optimistic 49 pessimistic.

Passed the Senate on February 24 2010 70-28. PDF 266MB Budget 1984-85. Were taking a look.

These are planned maintenance events and will persist until further notice. Show Details Apr 3 2022. 13-2081 Tax Examiners and Collectors and Revenue Agents.

3933 by Max Baucus DMontana. Line 14 Deductible part of self-employment tax A taxpayer may be classified as an independent contractor for federal purposes and as an employee for California purposes. 13-2080 Tax Examiners Collectors and Preparers and Revenue Agents.

In 2020 the IRS continued to accept paper Form 990-T Exempt Organization Business Income Tax Return and Form 4720 Return of Certain Excise Taxes Under Chapters 41 and 42 of the Internal Revenue Code pending conversion into electronic format. To help you find what you are looking for. Hello and welcome to Protocol Entertainment your guide to the business of the gaming and media industries.

See Patient-centered outcomes research PCOR fee IRS No. Check the URL web address for misspellings or errors. A 2020 qualified disaster area is any area in which a major disaster was declared before February 26 2021 by the President under section 401 of the Stafford Act and that occurred after December 27 2019 and before December 28 2020.

Use our site search. News and opinion from The Times The Sunday Times. You can include in medical expenses a part of a life-care fee or founders fee you pay either monthly or as a lump sum under an agreement with a retirement home.

Show Details Apr 3 2022. With workflows optimized by technology and guided by deep domain expertise we help organizations grow manage and protect their businesses and their clients businesses. Forty-nine percent are optimistic while 46 percent are pessimistic.

Introduced in the House and Senate as Foreign Account Tax Compliance Act of 2009 S. Optimism has been similar in more recent years but has decreased 7 points since we first asked this question in September 2017 56. The gov means its official.

Return to the home page. Tax Accounting. Federal government websites often end in gov or mil.

You can prepare the tax return yourself see if you qualify for free tax preparation or hire a tax professional to prepare your return. A Definition of covered periodIn this section the term covered period means the period beginning on March 1 2020 and ending on December 31 2020. The article number or location in the tax treaty that contains the saving clause and its exceptions.

Global Service Providers Guide 2022 By Chemical Watch Issuu

Normal Tax Return Preparation Fees Genesis Tax Consultants

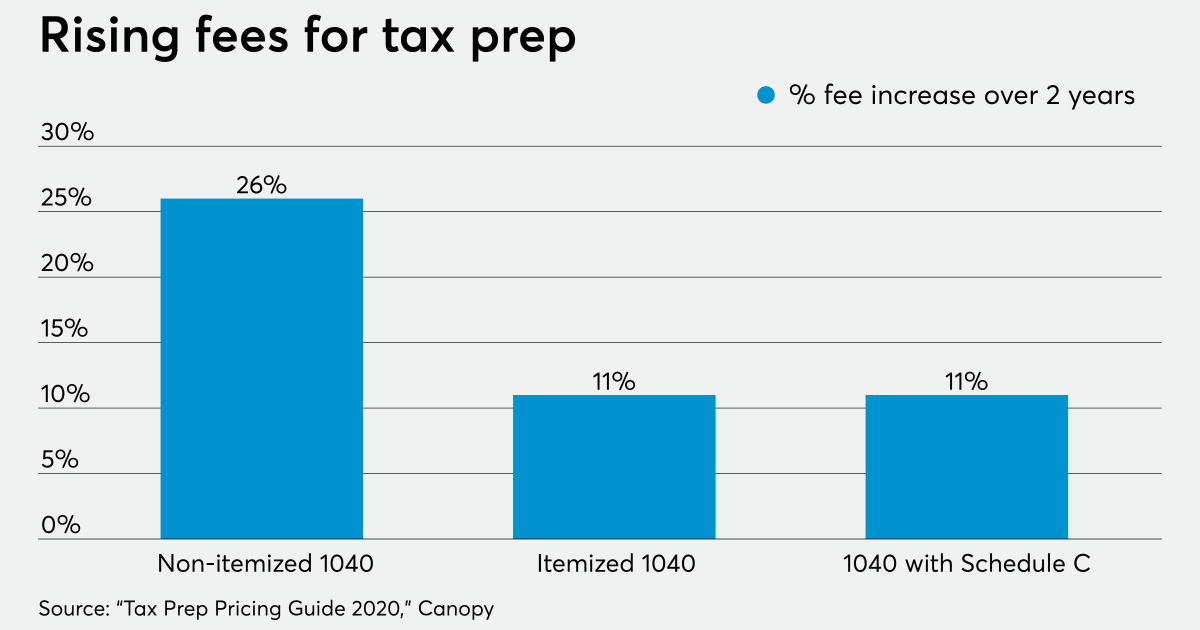

How Much Tax Preparers Are Hiking Fees And Why Accounting Today

Pickering Public Library April Monthly Calendars

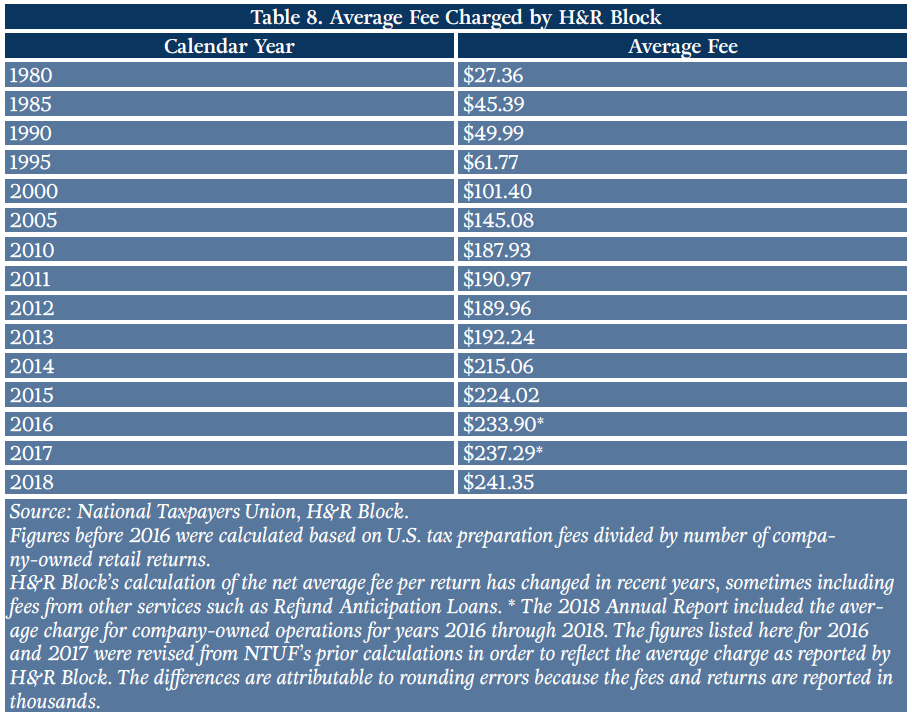

Tax Reform Bill Made Modest Progress Toward Simplification But Significant Hurdles Remain Foundation National Taxpayers Union

Midnight Sun Twilight Series 5 Meyer Stephenie Amazon De Books

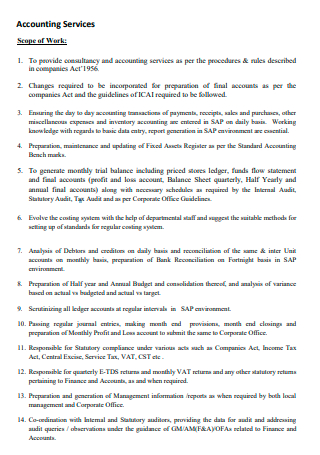

Sample Scope Of Work For Accounting Services 6 In Pdf

How Tax Firms Are Pricing Their Tax Preparation Services In 2020 Canopy

Pdf Methods In Biobanking Edited By Joakim Dillner Methods In Molecular Biology 675 Zhongzhou Yang Academia Edu

Ultimate Guide For New Tax Preparers

Vocational Education And Training In Europe Italy Cedefop

Dbczbp Nptlwzm

The 2022 Guide To Kyc Aml For Crypto Exchanges Wallets Getid

Fees Tax Preparation Service

8th Wall Documentation

Big Jumps Seen In Tax Prep Fees Survey Accounting Today

How Much Does It Cost For Tax Preparation